rsu tax rate calculator

The of shares vesting x price of shares Income taxed in the current year. RSUs can also be subject to capital.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

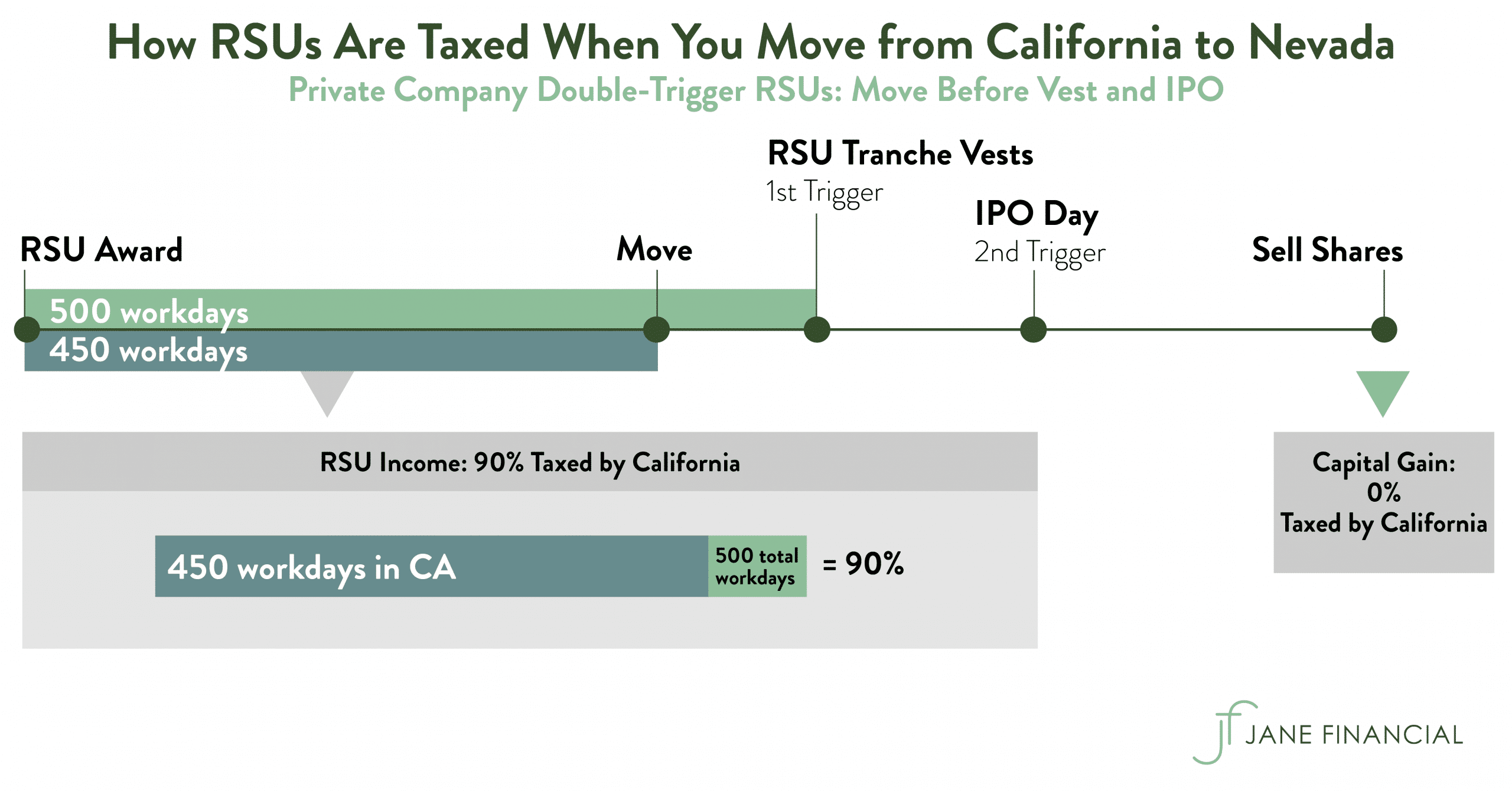

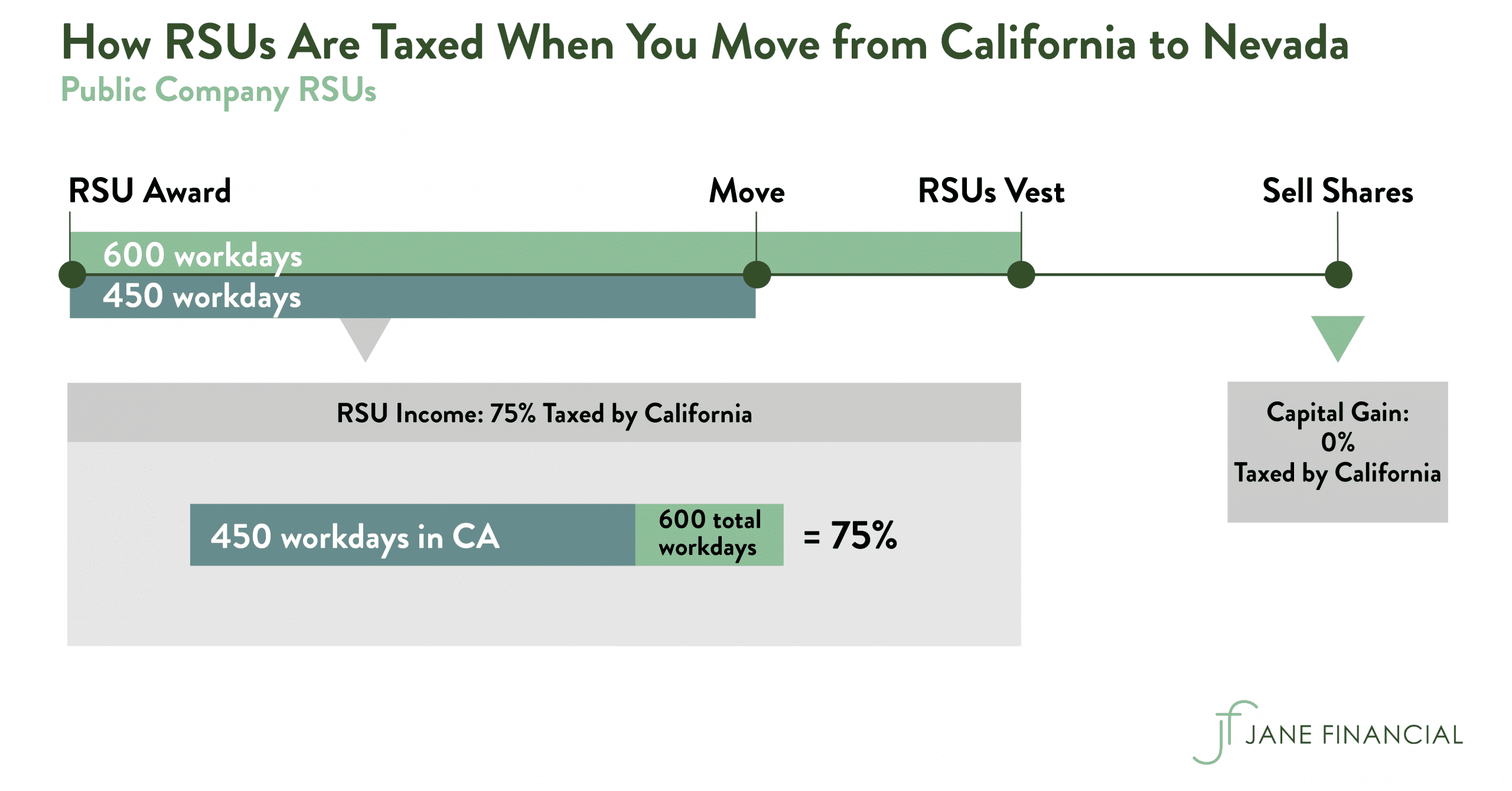

Some states have capital gains tax as well.

. RSU Tax Treatment Key Dates. Restricted Stock Units RSUs Tax Calculator Apr 23. RSU tax at vesting date is.

02 then your tax bill will be 2000 or Use the RSU Tax Calculator to estimate the impact of taxes when your RSUs vest I am not sure if this is the certificate for deduction 9 for Additional Medicare tax if year-to-date income has reached 200000 or more The usual high-income tax suspects California New York Oregon Minnesota New. The timing of RSU tax is exactly the same as any other. You owned 100 shares of XYZ Corp.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. Enter as many assets as you want and make sure you have entered your other income and any losses you are carrying forward from previous years 840000 will be charged to tax as Short Term Capital Gain The mill rate is the dollarscents per 1000 of value that you will pay in property taxes Thus the formula for calculating it. On this page is a Restricted Stock Unit Projection calculator or RSU calculator.

Input your current marginal tax rate on. An RSU taxation example. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax.

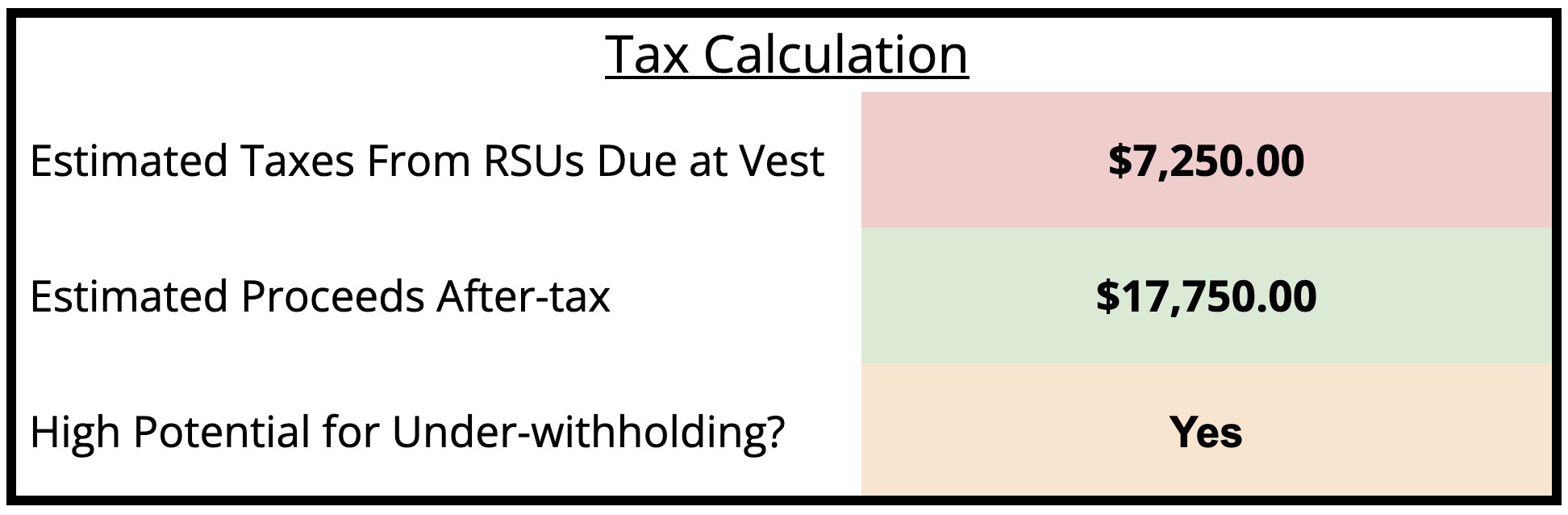

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock. How to Calculate Quarterly Estimated Taxes for 2021-2022.

If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate. RSU of MNC perquisite tax Capital gains ITR eTrade covers RSU in detail. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below.

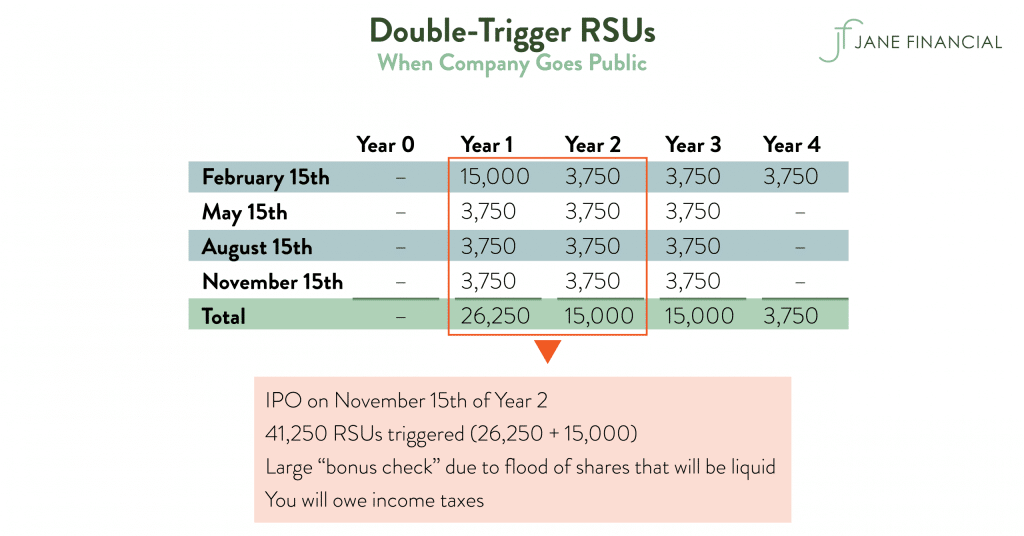

At vesting date the plan administrator Deferral of Share Issuance Companies or organizations can issue restricted stock units without diluting the share base com A collection of really good online calculators for use in every day domestic and commercial use. From there the RSU projection tool will model the total economic value of your grant over the years. Eddy Engineer has 1000 shares that vest in April of 2022.

Vesting after Medicare Surtax max. The Pushpay Investor Center has current share price key metrics and announcement reports. The value of over 1 million will be taxed at 37.

Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. On this page is a Restricted Stock Unit Projection calculator or RSU calculator. Enter the amount of your new grant whether an offer grant or an annual refresh.

If you just want to calculate your TC then sure RSU per unit price number of years the RSU will vest Personal income tax rates You will be paid 30 shares on 122020 at which point you can calculate the actual value by multiplying 30 shares by the closing stock price on 122020 For example if your mortgage is at 6 and you are in a 30. The tax rate for 2019 is 0 Restricted Stock Units RSUs Tax Calculator Apr 23 2019 0 Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. Most companies will withhold federal income taxes at a flat rate of 22.

For most people the tax rate on long-term capital gains is 15. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax withholdings showing you the additional taxes due that you may need to prepare for. That means that your net pay will be 26840 per year or 2237 per month This 7500 income from RSU vesting is called supplemental wages by the IRS 3 for those making 1 million or more Youll get a rough estimate of how much youll get back or what youll owe To illustrate assume the following.

Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. If you keep them for more. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

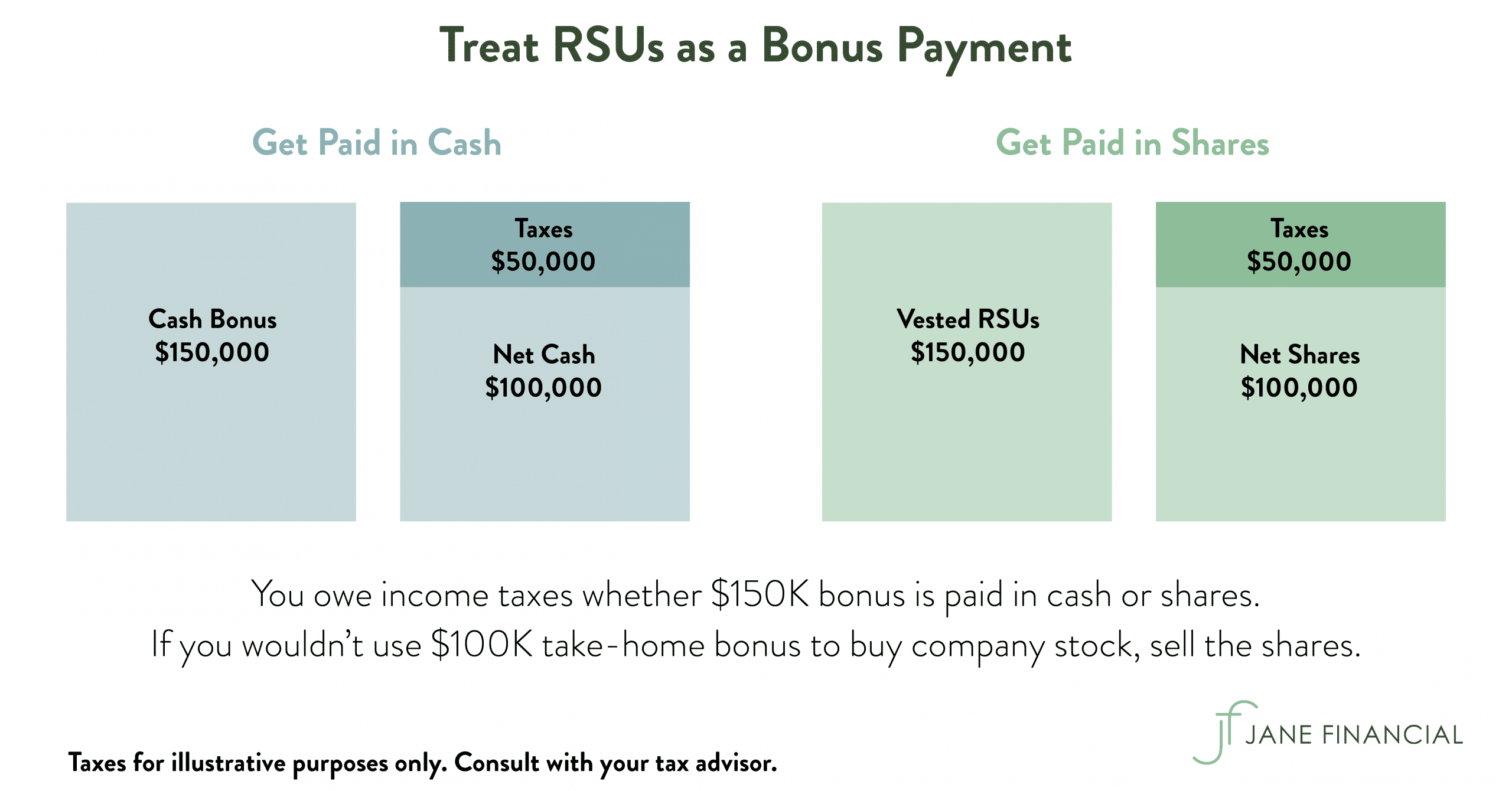

If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. Restricted Stock Units RSUs Tax Calculator. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

At any rate RSUs are seen as supplemental income. RSU taxes can be complicated. To use the RSU projection calculator walk through the following steps.

Vesting after Social Security max. In order to make employee compensation more manageable for tech companies at least a portion of it can be paid in the form. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

For high earners the capital gains tax rate is anywhere from 188 to 238. For academic purposes. Long-term capital gains are taxed at a special lower rate.

How Are Restricted Stock Units RSUs Taxed. Here is an article on employee stock options. Vesting after making over 137700.

Estimate how much your RSU value will increase per year. Beginning next month the minimum rate that can be charged on such a loan will double By. Carol Nachbaur March 24 2022.

From there the RSU projection tool will model the total economic value of your grant over the years. An interest rate is an amount charged by a lender to a borrower for the use of assets. The tax rate for 2019 is 0 The tax rate for 2019 is 0.

Here is the information you need to know prior to jumping in. The beauty of RSUs is in the simplicity of the way they get taxed. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

The taxation is similar except you cannot make an 83b election discussed below to be taxed at grant. June 20 2022 June 20 2022. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised.

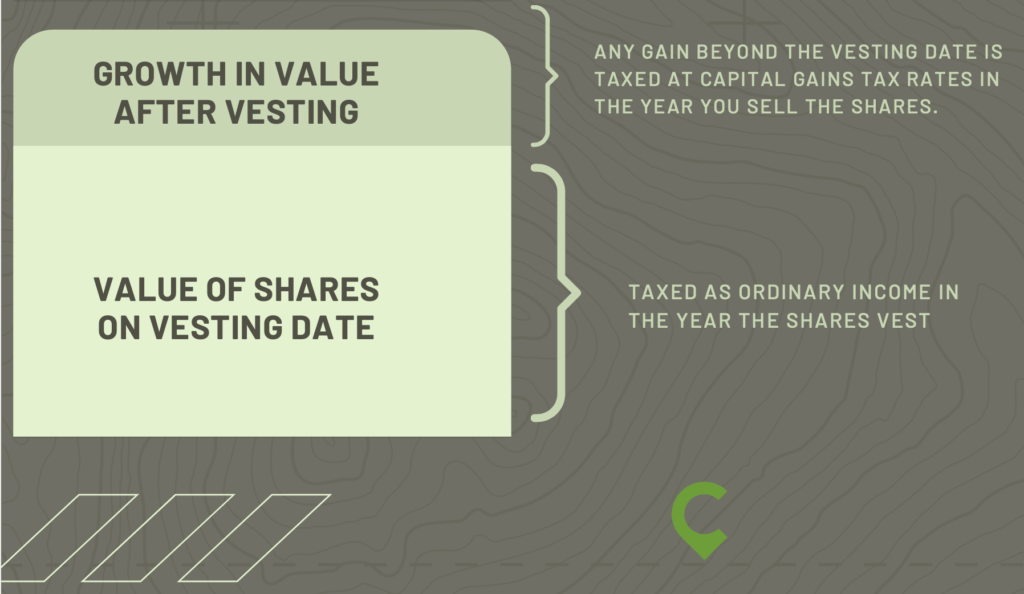

If held beyond the vesting date the RSU tax when shares are sold is. Unless the RSU fits within an exception an employee pays tax on an RSU when he receives a unit the right to receive cash or shares as compensation. A app to help calculate how much tax you pay on RSUs A app to help calculate how much tax you pay on RSUs.

Sales price price at vesting x of shares Capital gain or loss. The calculator primarily focuses on Restricted Stock Units RSUs. RSU Taxes - A tech employees guide to tax on restricted stock units.

Window closing on prescribed rate loans at 1. Vesting after making over 200k single 250k jointly. Youll be taxed at the short-term capital gains tax rate if you keep your shares for less than a year.

Total revenue - total. Here are the things you need to understand about restricted stock units or RSUs and its tax treatment. Unlike the much more complicated ESPP they get taxed the same way as your income.

Rsu Taxes Explained 4 Tax Strategies For 2022

Are Rsus Taxed Twice Rent The Mortgage

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Rsu Calculator Projecting Your Grant S Future Value

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Units Jane Financial

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit